WA Purchase and Sale Agreement free printable template

Show details

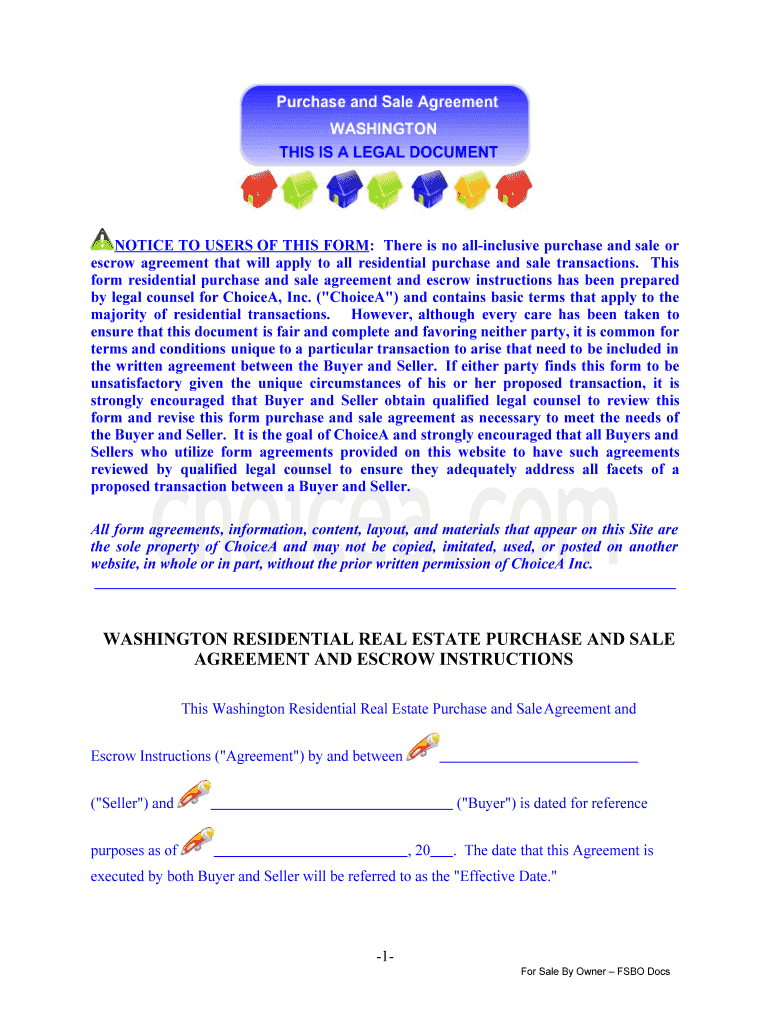

-1For Sale By Owner FSBO Docs Recitals A. Seller is the owner of the real property and improvements the Property located in the City of of Washington commonly known as County of State following legal description Insert Legal Description The parties hereby authorize the escrow agent to insert the proper legal description in this Agreement. THE INCLUSION AND ACCURACY OF THE LEGAL DESCRIPTION ARE NECESSARY ELEMENTS OF THIS AGREEMENT Property Parcel Identification Number number may be obtained...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign washington purchase form pdf

Edit your washington purchase form printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your washington purchase real online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wa state home purchase agreement printable online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit wa state purchase agreement blank form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fillable washington state pdf form

How to fill out WA Purchase and Sale Agreement

01

Begin by entering the date of the agreement.

02

Fill in the names and contact information of the buyer and seller.

03

Provide the property address and legal description of the property.

04

Specify the purchase price and the terms of payment.

05

Outline the closing date and any contingencies (e.g., inspections, financing).

06

Include any special provisions or additional terms agreed upon by both parties.

07

Ensure both parties sign and date the agreement.

Who needs WA Purchase and Sale Agreement?

01

Buyers looking to purchase real estate in Washington State.

02

Sellers wanting to formalize the terms of a property sale.

03

Real estate agents representing either buyer or seller.

04

Investors conducting property transactions.

Fill

fillable wa sale fillable

: Try Risk Free

People Also Ask about form wa real printable

How to sell my house without a Realtor in Washington state?

Get started! Step 1: Prepare your home for sale. Small upgrades and repairs can make a big difference in swaying potential buyers. Step 2: Set a price. Pricing strategy can make or break a FSBO sale. Step 3: List your Washington home. Step 4: Show your home. Step 5: Negotiate for the best possible price. Step 6: Close.

What is required to be included in a real estate purchase contract in Washington state?

These elements include: the parties involved in the transaction, the property for sale or lease, the purchase price or lease rates, the closing date, and the signatures of all the relevant parties. We also reviewed the five elements needed to have a valid contract in Washington.

How to sell house for sale by owner in Washington state?

Get started! Step 1: Prepare your home for sale. Small upgrades and repairs can make a big difference in swaying potential buyers. Step 2: Set a price. Pricing strategy can make or break a FSBO sale. Step 3: List your Washington home. Step 4: Show your home. Step 5: Negotiate for the best possible price. Step 6: Close.

Can you sell your own house in Washington state?

Selling a property in Washington State without a Realtor will help you save 2.5% to 3% on the listing agent commission. You Can Hit the Market Quickly & Sell Fast: You can list your house yourself whenever you are ready.

What agreement is required before selling a property in WA?

This is known as the Contract for Sale of Land or Strata Title by Offer and Acceptance (or O and A, for short). Your legal representative will also need to provide a Joint Form of General Conditions for the Sale of Land (the General Agreement) to you and the buyer when an offer is made.

Can I sell my own home in Washington state?

Technically, no. The state of Washington does not require you to hire a real estate attorney to sell your house. However, it's always smart to have a legal expert on your side when dealing with any transaction that involves complex contracts and large amounts of money.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit agreement wa sale blank in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your wa purchase fsbo, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit fillable sale state on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing fillable washington agreement.

How do I fill out fillable washington state printable on an Android device?

On an Android device, use the pdfFiller mobile app to finish your real estate purchase agreement washington state. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is WA Purchase and Sale Agreement?

The WA Purchase and Sale Agreement is a legal document used in the state of Washington to outline the terms and conditions between a buyer and a seller for the purchase of real estate.

Who is required to file WA Purchase and Sale Agreement?

Both the buyer and seller are required to complete and sign the WA Purchase and Sale Agreement. It is typically prepared by real estate agents or attorneys representing either party.

How to fill out WA Purchase and Sale Agreement?

To fill out the WA Purchase and Sale Agreement, parties must enter the property details, purchase price, closing date, contingencies, and other relevant terms. It should be reviewed for accuracy and completeness before signatures are obtained.

What is the purpose of WA Purchase and Sale Agreement?

The purpose of the WA Purchase and Sale Agreement is to legally document the agreement between the buyer and seller for the sale of property, ensuring all parties are aware of their rights, responsibilities, and obligations.

What information must be reported on WA Purchase and Sale Agreement?

The WA Purchase and Sale Agreement must include information such as the names of the parties involved, property description, purchase price, earnest money amount, closing details, contingencies, and any additional terms agreed upon.

Fill out your WA Purchase and Sale Agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fillable Washington Fillable is not the form you're looking for?Search for another form here.

Keywords relevant to fillable washington state fillable

Related to washington agreement fsbo

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.